How Systemizing Your Business Finances Will Make You Into a Money-Making Machine

As a solopreneur, I am responsible for every aspect of my business… this includes the things I love (working with clients, designing workflows and processes) as well as things that I don’t (finances, accounting, and bookkeeping).

As I mentioned in a previous post, last year I got really caught up in client work. Almost, too caught up. I was taking on project after project… anything that matched my skill set.

I lost focus on what and who I loved working with. I felt like I was drowning.

I was on the brink of going back to my 9-5 corporate job (I can’t even believe that I am admitting this!)

Lucky for me, I had a moment of clarity and was able to get my focus back on track… and get back to the work and clients that I loved.

However, it wasn’t without some repercussions to how I had handled my business during that time period.

I was working on client work so much, I had really let go of some of the important aspects of running a business – like managing my finances.

As soon as I was busy, my finances went to the wayside. I didn’t have time (or energy) to take care of this. It was easy to procrastinate because I didn’t like it. And, it didn’t directly impact my client work.

I was so caught up in the whirlwind of projects, time slipped away and so did my tracking. And rather than keeping control over the incoming and outgoing cash, I just used what I needed, when I needed it.

What was the result?

At the end of the year when I did my annual budget review, I had spent a LOT of money! More than expected, and likely, more than I probably needed to.

On top of that, I really didn’t leave anything extra for myself… a bonus of sorts for all of the hard work and effort I put in.

I worked my butt off… and at the end of the day, I was still in the same financial position I had always been in.

This is just another example, of why I DIDN’T start my own business! I was looking for financial freedom and the ability to exceed any glass ceilings that corporate placed on me.

Feeling a little frustrated, and annoyed with myself, I vowed to never let this happen again, and I sought out a solution.

For me, as a super type A systematic person, I knew the solution needed to be systems based. It had to be easy, and I could add it into my existing workflows with a checklist and block into my calendar each week.

Mindless, perhaps you might say.

Ironically enough, as soon as I made this decision, a colleague recommended the book Profit First by Mike Michalowicz, and I thought it might be a good place to start.

Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine

Profit First recognizes that business owners do not have time to be accountants and bookkeepers, but must have a handle on the day-to-day finances of their business. This includes, putting yourself and paying yourself FIRST and the business second.

This means that you are working your business in the present moment, not what you hope or project to have in the future.

When profit comes first, you can build a business that feels good (because you are making money) but is also operating within its means.

I know it seems simple, but the fact is, most people who start businesses are not thinking this way (I definitely was not!) I put everything into the business first and took home whatever was left.

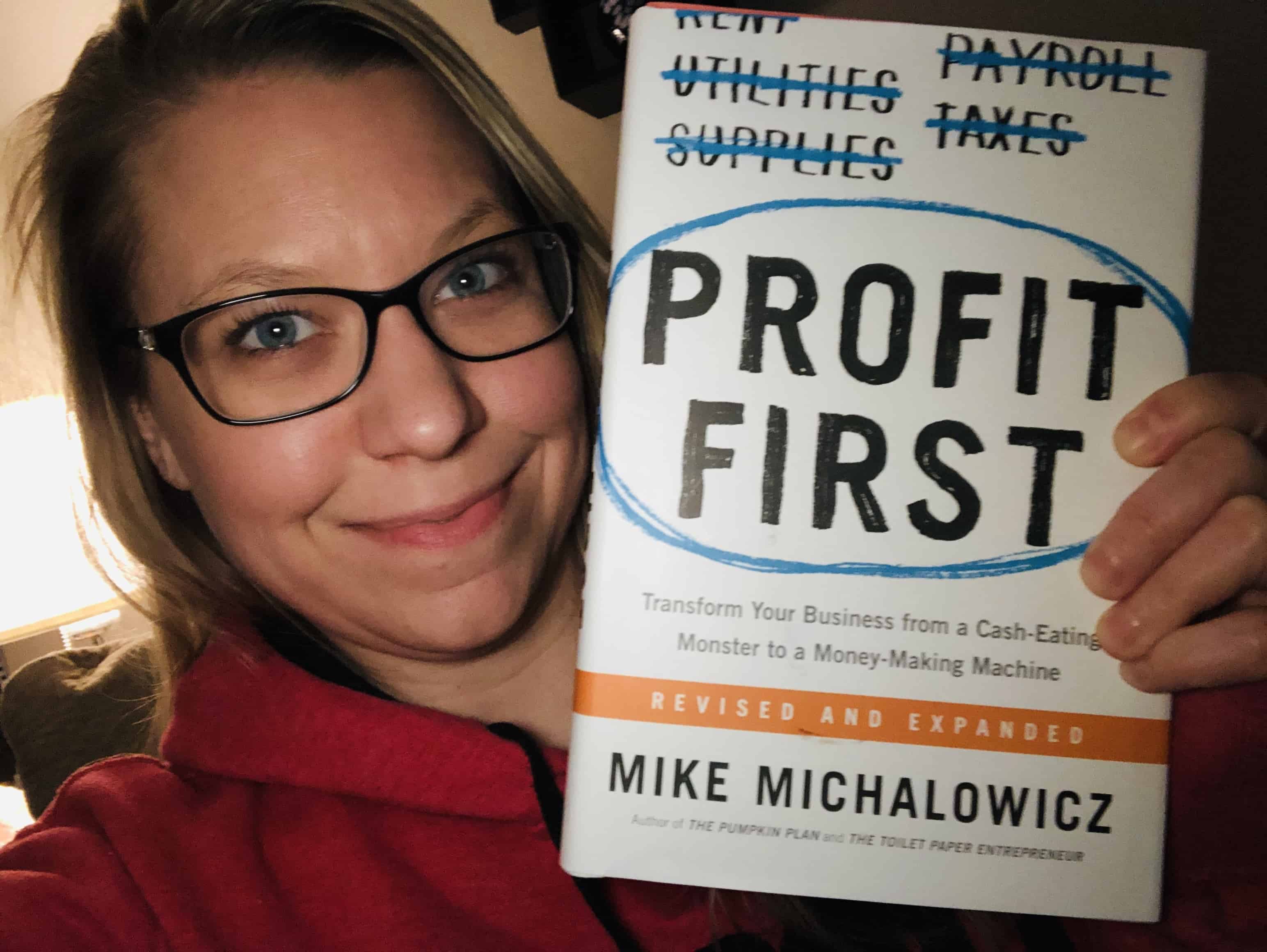

You might consider this important because, according to the Small Business Administration (SBA) Office of Advocacy’s 2018 Frequently Asked Questions, roughly 80% of small businesses survive the first year. That number might be surprisingly high to you, especially considering the commonly-held belief that most businesses fail within the first year.

However, from there the number falls sharply. Only about half of small businesses survive passed the five-year mark, ranging from 45.4% to 51% depending on the year the business was started. Beyond that, only about one in three small businesses get to the 10-year mark and live to tell the tale.

Mike Michalowicz is on a mission to change these numbers and get business making profit, in a smart and systematic way so that they don’t become another statistical failure.

The Profit First System

The Profit First system is fairly simplistic and easy to begin implementing once you understand the generic concept.

There are three primary steps to setting up your Profit First system:

- Complete an instant assessment.

- Create your Profit First goals as small, incremental changes based on your assessment.

- Set up your bank accounts and distribute your income appropriately, twice per month.

If you have maintained decent accounting practices via Quickbooks or other financial tools, you can work through the instant assessment in less than an hour. In fact, once I completed the book, I was able to set up the Profit First system for my own business in just a few hours.

The Instant Assessment

Before you can begin the profit first system, you have to complete a Profit First Instant Assessment. This quick chart allows you to gauge the current status of your business and where your money is going.

The Instant Assessment helps you identify your baseline; what percentage of your income is going to profit, operating expenses, taxes, owner’s compensation, etc.

It’s ok if you don’t have income being disbursed to any of these places. Profit First is here to help you work that out.

The book provides many examples of where five-figure, seven-figure, and businesses anywhere in between have started and made progress with Profit First. It doesn’t matter where you are, as long as you start.

This assessment is critical because it provides a baseline for new goals.

As scary as it is, it’s the first step to getting your business in alignment.

Hello, bonus time!

Once you have completed your business assessment and know your baseline numbers and percentages, you are able to then identify your incremental goals.

Profit First does not advocate radical, drastic changes. In fact, the system only recommends a 1-2% change per quarter in the income disbursement you are making.

Over time, as you continue to shift your income disbursements around, you will then start to see how you can build your own system focused on you first, and the business second.

What I am most excited about? Profit First emphasizes an “owner’s compensation” account where each quarter the account is split up to each of the business owners as a bonus. Since I’m a solopreneur, I’m really looking forward to my first quarter’s bonus (and not sharing it with anyone!)

Mike also makes the critical point – your bonus is YOUR bonus and should not be reinvested in the business!

Systemizing Your Income

The last step of Profit First is to create different bank accounts for income distribution so that you quickly check the status on any account each day. Then only, twice a month you conduct your transfers, pay yourself, and pay your bills.

^ I’m most excited about this.

No more guessing, no more moving on a whim. What’s in my profit account is my profit… what’s in my operating expenses account, is for my business bills. (Yes, there is a savings and tax account as well).

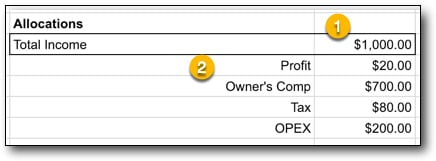

For my own ease an efficiency, I created a simple spreadsheet with a formula that allows me to enter in the total amount in my income account (1), and how much should go to each sub-account (2). Twice a month, I pay myself and pay then my bills.

Brainless accounting achieved

I know it sometimes it’s not always fun to be running your own business; especially when you have to do the things that are out of your zone of genius.

It’s really easy to put them off and procrastinate.

But take my advice – figure out a way to make it simple, easy, and systemized, then it might even be a little bit fun!

(For real: I am really enjoying the guiltless payments to myself! THIS is what owning your business should be about!)

Ready to try this out for yourself? Check out Mike’s book, Profit First here on Amazon.

Disclaimer: Lindsay Kirsch, LLC is an Amazon Associate. As an Amazon Associate, I earn from qualifying purchases based on links that you click on from my site. Everything I recommend on here is my own opinion and words.